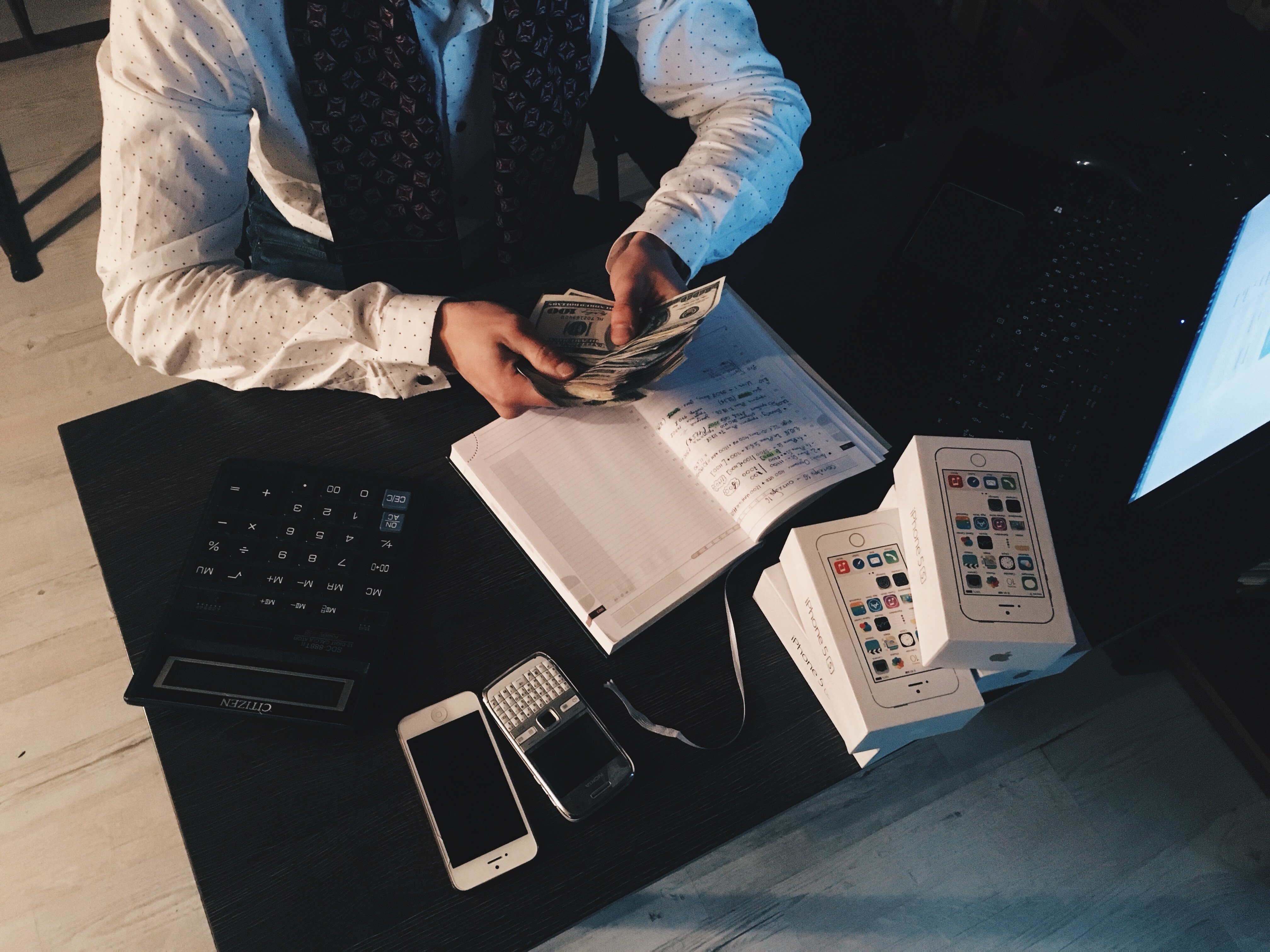

Do you aspire to be the next BILL GATES? This is for you.

In a highly technological revolving world, one has to grip with innovation. The millennial era has predominantly taken part on the switch of career preferences. Business has become the harmony of the society. The most number of millennials do not aim for an employment anymore; instead, they wanted to see themselves as the hirer. In fact, according to a survey, 67% of millennials said that starting their own business is their priority and only 13% of the respondents said that their career goals are into their dream job.

The key to every successful business is to be able to sustain. Even though the growth over months isn’t that extraordinary, at least it’s moving. And how does sustaining a new business become easy? Firstly, separate your personal money to your business money. And since the most common reason for the downfall of businesses is the wrong handling of money.

Let me share with you the easiest tactic I and my Family have been doing for years and it is surprisingly effective.

So, here’s the right way of spending your income so you won’t have to run out of cash and bury your business to death.

This is called the seven jar system by a famous entrepreneur but I kind of revised it.

Daily Fund- 50%

Your daily expenses would include the essentials you should buy in every day. Your food, water, and transportation are the main inclusions for it. Expenses must not be increasing if we aim to make our income allocation higher than the emancipation fund.

Emergency Fund- 10%

This budget will liberate you from being worry-free the moment you’re put into a tight situation. You won’t have to borrow money to anyone. You will be able to pay your utility bills, hospitalization, amortization, and medicine, etc. Even if you also have small income for months, you can likely survive since you have this budget. It will help not to withdraw money from the bank.

Investment Purposes Fund – 20%

This is what we also call freedom. Not only the freedom from debt but also starting to make money work for you. Make it a habit of putting in 20% of your income and you will certainly get used to it. You will use this money to grow your business or invest in other big companies. Remember, be wise in investing. You may talk or get an advice to financial advisors before finally investing. You cannot just invest without knowing the whole system. There are a lot of investment scams that has been operating widely. Real property, paper business and stock market investing would be great choices this generation, sway with it.

Dream Fund – 5%

Have at least 5% of your income set aside for this dream fund. This fund will be utilized for your dreams. These may be sending your kids to school (if you have any), buying a new car, building your dream house, purchase of a new phone or travel with family abroad. You won’t have to break your pocket just to have those dreams; learn to be patient by putting discipline on your money habits.

Blissful Fund- 5%

You won’t have to cause yourself some guilt anymore by trying to socialize and try to have fun outside the business world. If you put 5% of your income to the blissful fund; you will be able to buy tickets for a movie, concert, eat in classy restaurants, go fit and healthy, and buy new clothes. Do not forget to enjoy life while you have time in this world. We do not live just for money, money, money alone.

Intelligence Fund- 5%

Net worth is just our material possessions. My father told me before when I was starting my own business; ‘While you are young, collect experiences more than materials things, it will help you grow.’ It is very true. We must invest at least 5% of our income to books, seminars, coaches who teach us the right mindset towards growing our money in business. Our mind, character, and knowledge will become more advanced than ever. Truly, a 5% part of our income would be worth it.

Donation Fund- 10%

Since material things on this earth aren’t temporary. We can donate at church or donate at charities. It would just depend on you on where you wanted to. Some people are not just as blessed as you do, so a 10% may help change lives.

Most young entrepreneurs may find it hard to sustain their business if they don’t possess the right mindset and attitude towards business. They would also find the money handling as the main problem if they don’t analyze and study well the right financial approach of being a newbie in a business world. Keep those disciplines in mind and may it help you succeed. The greatest percentage of triumph relies on your hands.

Kathleen Tan is a writer and editor of Scoopfed.com. Aside from writing, she also loves to travel with best friend, cook Chinese cuisines, and read fiction books. She also owns a shop and loves investing in the stock market and other companies.