The global financial crisis of 2008 was one of the worst since the Great Depression of 1930. What sparked off with the subprime mortgage crisis in the United States soon translated into an international banking crisis, and demonstrated to us once again the perils of the interconnected world that we live in today.

Once considered to be infallible, Lehman Brothers, a renowned investment bank, collapsed in 2008. Other banking powerhouses such as Merrill Lynch, AIG, Freddie Mac, Fannie Mae, HBOS, Royal Bank of Scotland, etc., faced the heat as well, reporting huge losses. The federal government had to step in to bail out these troubled banks.

The banking crisis that was triggered in 2008 is a perfect case in point to think of reforms in the banking sector. Automation is one area where the banking industry has been caught off-guard over the years, something that is gradually changing now.

Automation in the Banking Sector

Employee-Free Branches

Who would have thought that we would walk into a bank’s branch one day and would not have to deal with humans at all? Well, that’s precisely what Bank of America has managed to achieve by opening three fully-automated bank branches in the US, as reported by Reuters.

Back Office Operations

While a lot of focus has gone into (and rightly so) automating front-end customer interactions, such as the introduction of ATMs and online banking, there is still a lot that needs to be done in other areas, such as improving back-office operations through automation, which can help cut down losses and improve operational efficiency to a great extent. Improvements in IT infrastructure, by doing away with legacy systems, can be a good place to start. A new way to ensure IT-enabled banking operations calls for out-of-the-box thinking to introduce the right mix of integrated solutions and automate inefficiencies wherever found says a report by McKinsey & Co.

Emerging Technologies

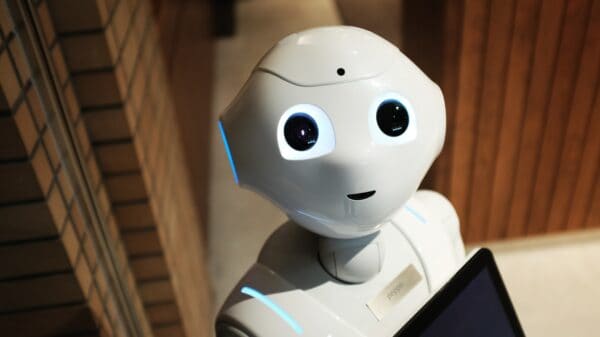

• Artificial Intelligence (AI) –Banks have typically been slow in embracing new technologies, as compared to many other industries. AI is one technology that has the potential to revolutionize the banking industry. Personalized communication and advice to customers can occur on a real-time basis, thereby improving the customer’s experience with the bank.

• Blockchain – A Fintech revolution that has the potential to be the disruptive force in banking reforms is blockchain, the underlying technology in Bitcoins. This technology will help enable faster, secure and transparent transactions for banking customers. Settlement time can be reduced to just a few seconds with the removal of third parties and intermediaries.

Robotic Process Automation

The avalanche of documents that banks have to process every month is one area where the introduction of Robotic Process Automation (RPA) will help. It will not only improve processing time but will also cut down issues that arise out of manual errors. Employees can also quickly retrieve digitized data and this is something that can speed up the process of banking audits as well. Customer onboarding and mortgage lending are two areas that can immediately benefit from automation in the banking sector, according to AutomateWork.

Enterprise Resource Planning (ERP)

ERP solutions can be implemented in a wide array of banking services to improve efficiency. From payment processing to asset management and generation of financial statements, ERP reporting systems are the need of the hour.

In today’s volatile and largely interconnected world, there is no comfort in a safe harbor for any bank, large or small. The banking industry will have to be quick to adapt to the changing times to avoid a situation similar to what happened in 2008.

Marcelo Fincher is a blogger & writer on technology related topics with years of experience in studying technological advancements. In his spare time, Marcelo likes to read books and take a walk on the beach.